|

🦉Darwinex Zero | Attract Millions in Funding

|

TuringTrader empowers DIY investors to build diversified portfolios with a unique, data-driven approach. Designed for those seeking sustainable growth with reduced risk, TuringTrader offers robust portfolios and methodologies aimed at steady returns and minimized losses.

New users can explore TuringTrader with a 14-day free trial, gaining access to tools and insights that set a high standard for DIY investing. Use TuringTrader’s Portfolio Wizard to find the best-fit portfolio based on your financial goals and risk preferences.

With TuringTrader, take charge of your financial future and enjoy peace of mind knowing your investments are optimized for growth with reduced risk.

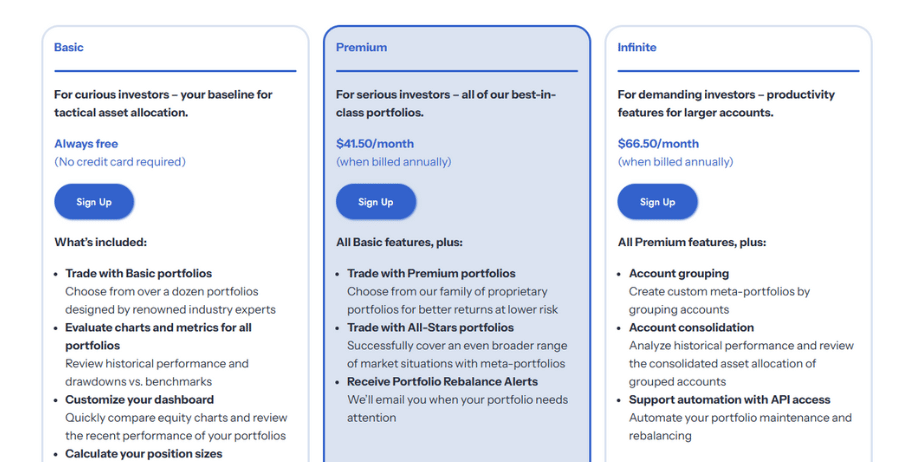

$25 discount off TuringTrader with Referral Code "ENDA25"

Leave a Review