To use SignalStack to automate trading via TradingView, follow these structured steps to set up a seamless connection between your TradingView alerts and your brokerage account for automated trade execution. This process does not require any coding knowledge, making it accessible for both amateur and expert traders.

Step 1: Sign Up on SignalStack

Begin by creating an account on SignalStack. This initial step is straightforward and sets the foundation for automating your trading process. Sign up here for access.

Step 2: Select Your Signal Source

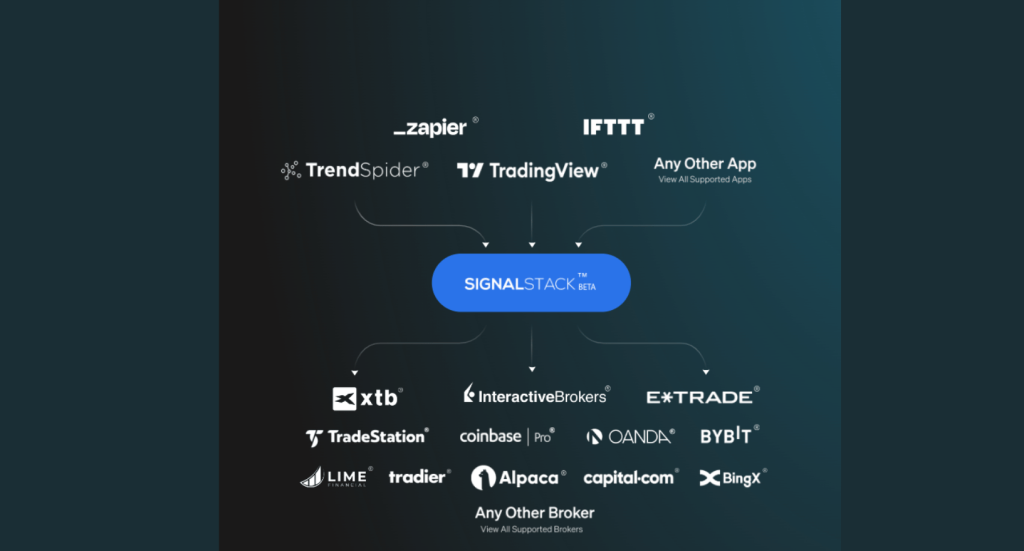

During the sign-up process, choose TradingView as your Signal Source. This selection is crucial as it determines from where your trading alerts will be sourced. SignalStack supports various sources including TradingView, TrendSpider, Zapier, and others capable of sending webhooks.

Step 3: Connect Your Broker or Exchange

After selecting your Signal Source, link your brokerage or exchange account to SignalStack. This step enables the automation of trade executions based on alerts from your chosen Signal Source. SignalStack supports a wide range of brokers including Alpaca, Coinbase, E*Trade, and many others.

Step 4: Configure Your Stack

With your broker or exchange connected, you’ll need to configure your stack. This involves setting up how orders are sent to your brokerage account based on the alerts received. It’s important to test your configuration to ensure orders are correctly formatted and can be executed as intended.

Step 5: Activate Your Stack

Finally, activate your stack by setting up alerts in TradingView to point to your SignalStack. This step varies depending on your Signal Source platform, but essentially, it involves configuring TradingView to send alerts directly to your configured stack in SignalStack.

By following these steps, you create a system that automatically captures alerts from TradingView and executes orders through your connected broker or exchange without manual intervention. This setup not only simplifies the trading process but also enables you to leverage automated trading strategies effectively.

Additional Features

- Webhooks: SignalStack allows for the creation of webhooks for each connected brokerage or exchange account, enabling the receipt and conversion of alerts into executed orders.

- Order Types: Support for various order types including Market, Limit, Stops, and more, offering flexibility in how trades are executed based on alerts.

- Asset Coverage: Capable of automating trades across a wide range of assets including Crypto, Stocks, Futures, Forex, and CFDs.

- Reliability: Fast and reliable order execution with a high uptime, ensuring your trading strategy is executed efficiently.

SignalStack provides a comprehensive solution for automating your TradingView-based trading strategy, making it an invaluable tool for traders looking to enhance their trading efficiency and accuracy.

Enda Cusack

Enhancing trading efficiency and accuracy through automated systems like SignalStack not only saves time but also minimizes the potential for human error. By automating the execution of trades based on predefined criteria and signals from platforms such as TradingView, traders can adhere more closely to their trading strategies, even during volatile market conditions. This continuity and discipline in trading practices can lead to improved performance and profitability. Below, we delve further into the advantages and considerations of using automated trading systems like SignalStack.

Advantages of Automated Trading Systems

- Reduced Emotional Decision Making: Automation helps to eliminate emotional influences from trading decisions, ensuring trades are executed based on analysis and predefined rules rather than fear or greed.

- Increased Speed of Order Entry: Automated systems can capture and execute trades at speeds impossible for human traders, a crucial advantage in fast-moving markets where milliseconds can make a significant difference in the outcome of a trade.

- Ability to Backtest Strategies: Before deploying capital, traders can backtest their trading strategies using historical data to assess the viability of a strategy. This can provide valuable insights and adjustments before real money is at stake.

- Diversification and Risk Management: Automation allows traders to easily manage multiple accounts and strategies simultaneously, spreading risk and increasing the potential for profit from various sources.

Considerations for Automated Trading

- System Monitoring: While automated systems can handle much of the trading process, they require regular monitoring for technology failures, connectivity issues, or anomalies in trading patterns that could impact performance.

- Understanding Limitations: It’s important to understand that no automated trading system can guarantee profits. Market conditions can change in ways that might not be anticipated by the system’s algorithms.

- Setup and Testing: Setting up an automated trading system involves a learning curve, including selecting the right signal sources, configuring settings, and testing the system to ensure it performs as expected.

Setting Up for Success with SignalStack and TradingView

- Clear Strategy Definition: Before automation, define your trading strategy clearly, including entry and exit rules, order types, and risk management criteria. This clarity is crucial for setting up your automated system effectively.

- Regular Review and Adjustment: Regularly review the performance of your automated trading system. Be prepared to adjust your strategy and settings in SignalStack based on performance and changing market conditions.

- Educational Resources: Utilize educational resources to improve your understanding of both TradingView and SignalStack. Both platforms offer documentation and support materials to help you optimize your automated trading setup.

Conclusion

Automated trading systems like SignalStack, when used effectively with signal sources such as TradingView, offer traders a powerful tool to enhance their trading efficiency and accuracy. By automating routine tasks and executing trades based on precise criteria, traders can focus more on strategy development and less on the mechanics of trade execution. However, it’s important to approach automation with a balanced perspective, recognizing both its potential and its limitations. With careful planning, monitoring, and ongoing learning, traders can leverage automation to achieve their trading objectives while managing risk.