D-Wave Quantum Inc. (NYSE: QBTS) has been making waves in the quantum computing industry and the stock market, with a recent surge in its stock price and a growing interest from both investors and industries leveraging quantum computing. This review explores the company’s technological innovations, recent market performance, and future prospects, providing an in-depth understanding of D-Wave Quantum Inc. and its position in the quantum computing landscape.

Overview of D-Wave Quantum Inc.

D-Wave Quantum Inc., headquartered in Burnaby, British Columbia, with additional offices in Palo Alto, California, is recognized as the world’s first commercial supplier of quantum computers. The company specializes in annealing quantum computing, a form of quantum computing particularly effective for solving complex optimization problems.

D-Wave’s mission is to deliver quantum-powered solutions that tackle challenges in logistics, artificial intelligence, drug discovery, scheduling, and cybersecurity. Their client roster includes prominent organizations like Mastercard, Ford Otosan, and NASA, underscoring their leadership in real-world quantum applications.

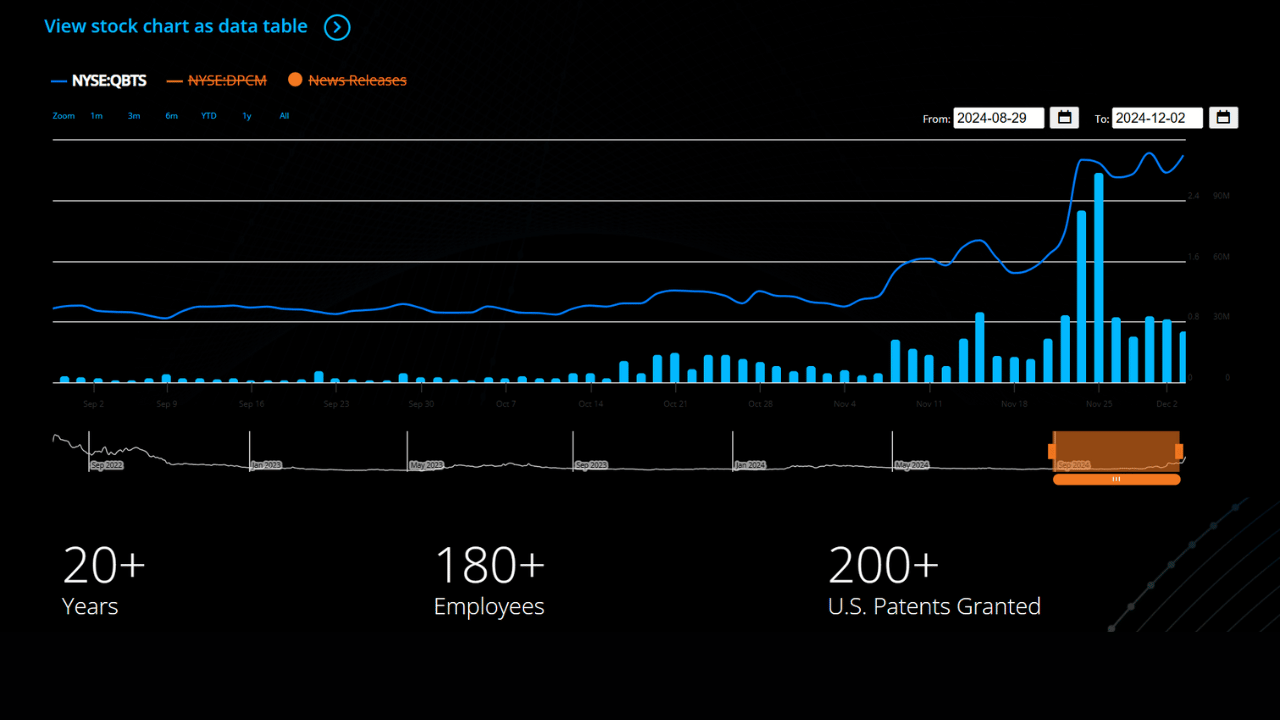

Recent Stock Performance

D-Wave’s stock performance in recent weeks has been nothing short of remarkable:

- December 6, 2024: The stock closed at $5.06, reflecting a 34.22% gain during regular trading hours and an additional 0.79% increase in after-hours trading.

- Year-to-Date Growth: D-Wave’s stock has soared 517%, driven by advancements in quantum computing and increasing investor confidence.

- Market Cap: The company’s market capitalization stands at $1.134 billion.

The stock’s trading volume on December 6 reached 84.7 million shares, significantly surpassing its average volume of 14.5 million. This surge indicates heightened investor interest, further fueled by the company’s innovative achievements and partnerships.

Technological Innovations and Commercial Applications

D-Wave’s annealing quantum computing systems are designed to address optimization problems across various industries. Some noteworthy applications include:

-

Retail Workforce Scheduling:

- A collaboration with Pattison Food Group achieved an 80% reduction in the effort needed to create schedules, showcasing quantum computing’s ability to streamline operations.

- A collaboration with Pattison Food Group achieved an 80% reduction in the effort needed to create schedules, showcasing quantum computing’s ability to streamline operations.

-

Manufacturing Production:

- At Ford Otosan, D-Wave’s systems reduced scheduling time by 83%, enabling more efficient use of resources and time.

- At Ford Otosan, D-Wave’s systems reduced scheduling time by 83%, enabling more efficient use of resources and time.

-

Telecommunications:

- D-Wave improved mobile network resource utilization by 15% for NTT Docomo, Japan’s largest mobile operator.

These examples demonstrate D-Wave’s potential to deliver real-world impact by solving computationally intensive problems that classical computers struggle to handle.

Quantum Computing Leadership and Industry Recognition

CEO Perspective

Dr. Alan Baratz, D-Wave’s CEO, emphasized the company’s pioneering role in the quantum computing industry during a recent interview on Fox Business’ Making Money with Charles Payne. Dr. Baratz highlighted that D-Wave’s systems are already in production, directly benefiting customers today.

Participation in Industry Events

At the Q2B24 Silicon Valley conference, D-Wave showcased how its quantum systems are driving tangible results. The event reinforced the company’s position as a leader in transitioning quantum computing from experimental stages to practical deployment.

D-Wave Analyst Ratings and Price Targets

Despite its recent stock performance, analysts are cautiously optimistic about D-Wave’s future:

- 12-Month Price Target: Analysts forecast an average price of $3.19, with a high of $4.50 and a low of $2.25, suggesting a potential downside from the current price.

- Ratings: D-Wave holds a strong buy consensus from five analysts, indicating confidence in its long-term potential.

Future Outlook

D-Wave’s roadmap includes advancements in both annealing and gate-model quantum computing. With plans to introduce even more powerful systems in late 2024 or early 2025, the company aims to solidify its technological edge.

Opportunities

- Growing demand for optimization in industries such as finance, healthcare, and logistics provides fertile ground for D-Wave’s solutions.

- Expanding partnerships with enterprises like Google, NASA, and Lockheed Martin could further accelerate adoption.

Challenges

- Quantum computing remains a nascent field with significant technical and commercial risks.

- Competitive pressure from companies like IonQ and Rigetti could challenge D-Wave’s market share.

Investment Considerations

Strengths

- Proven Applications: Demonstrated success in solving real-world problems positions D-Wave as a leader in the quantum computing space.

- Innovative Technology: D-Wave’s focus on annealing quantum computing sets it apart in the industry.

- Market Momentum: The company’s stock performance reflects strong investor interest and confidence.

Risks

- Valuation Concerns: The current stock price may be overextended, with analysts forecasting a potential downside.

- Earnings Uncertainty: The company has yet to achieve profitability, with a trailing EPS of -$0.41.

Conclusion

D-Wave Quantum Inc. stands at the forefront of the quantum computing revolution. Its ability to deliver practical applications today, coupled with its ambitious plans for future innovation, makes it a compelling player in the tech sector. However, potential investors should weigh the risks and rewards carefully, considering both the company’s groundbreaking achievements and the inherent volatility of the quantum computing industry.

As the quantum landscape evolves, D-Wave’s continued commitment to solving complex problems for businesses will be critical to its success and relevance in this transformative field.

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial or investment advice.