AI Managed Portfolios on eToro

eToro offers a range of AI-driven Smart Portfolios designed to cater to diverse investment strategies and risk appetites. These portfolios leverage cutting-edge artificial intelligence to enhance investment decisions and performance.

In this review, we look at eToro’s four flagship AI Smart Portfolios: AI Revolution, GainersQtr, OutSmartNSDQ, and ALTIA-Investment.

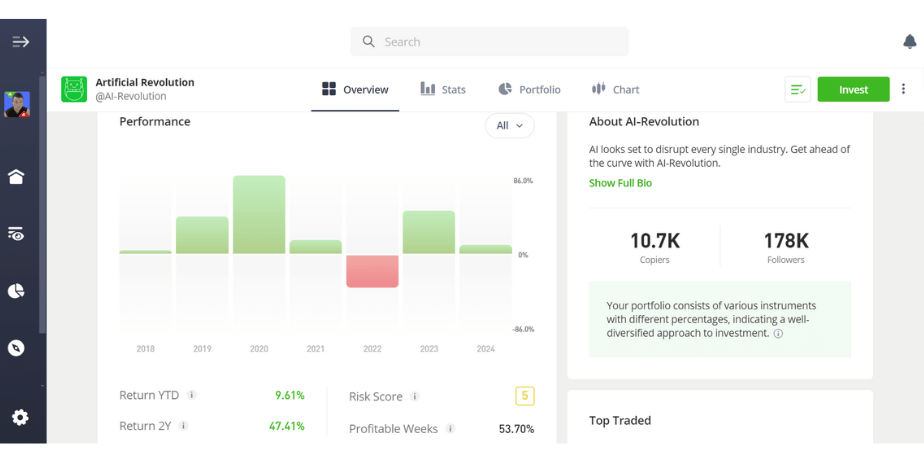

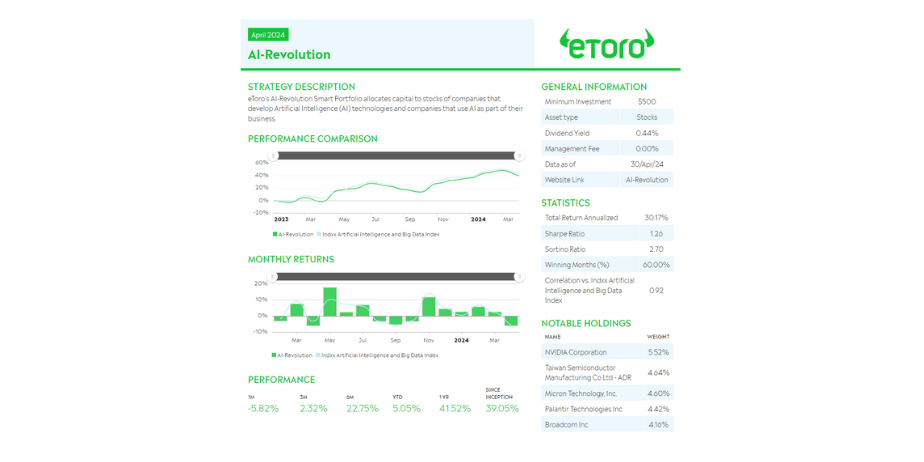

AI Revolution Smart Portfolio

The AI Revolution Smart Portfolio focuses on companies pivotal to AI technology and those integrating AI into their business models. It allocates 75% of its capital to providers of essential AI technologies and 25% to users of AI.

Investment Focus: Companies developing infrastructure technologies for AI applications and those using AI in their business strategies.

Strategic Allocation: Utilizes a rigorous screening process based on financial metrics, with annual rebalancing to adapt to market conditions.

Performance Metrics:

- Total Return (Annualized): 30.17%

- Sharpe Ratio: 1.26

- Sortino Ratio: 2.70

- Winning Months: 60%

Top Holdings: NVIDIA, Taiwan Semiconductor, Micron Technology

Minimum Investment: $500

Investor Suitability: Long-term investors focused on the AI sector’s growth potential.

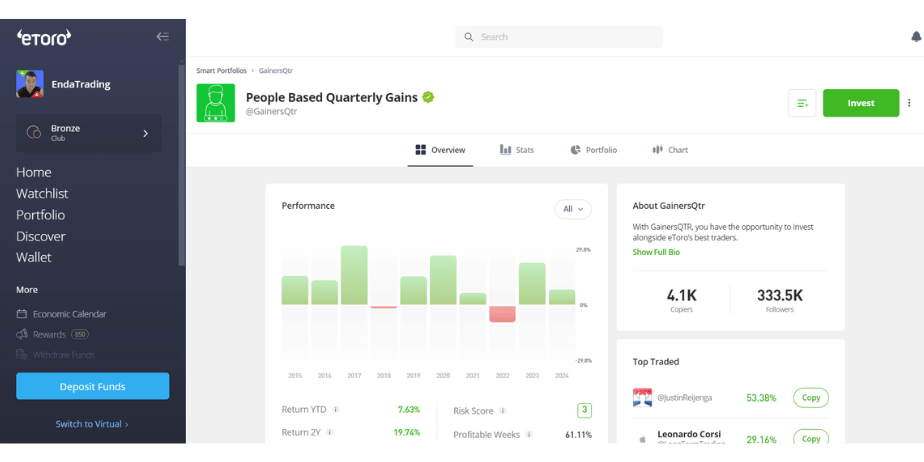

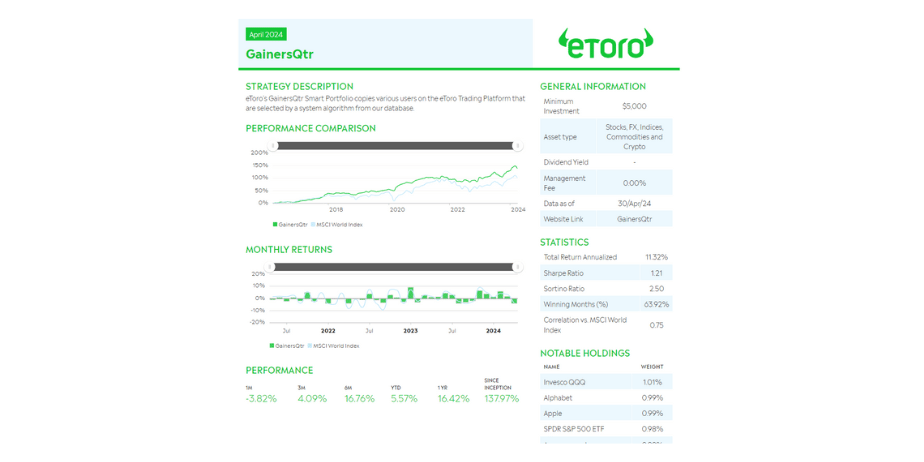

GainersQtr Smart Portfolio

GainersQtr uses advanced machine learning to select top-performing traders on the eToro platform, copying their trades to potentially replicate their success.

Strategic Investment Targets: Top-performing eToro traders across various asset classes including stocks, FX, indices, commodities, and crypto.

Algorithmic Selection and Risk Management: Employs machine learning for trader selection, with a 5% stop-loss policy for risk management.

Performance Metrics:

- Total Return (Annualized): 11.32%

- Sharpe Ratio: 1.21

- Sortino Ratio: 2.50

- Winning Months: 63.92%

Top Holdings: Invesco QQQ, Alphabet, Apple, SPDR S&P 500 ETF, Amazon.com Inc.

Minimum Investment: $5,000

Investor Suitability: Investors seeking to benefit from the expertise of proven eToro traders.

OutSmartNSDQ Smart Portfolio

OutSmartNSDQ aims to outperform the Nasdaq 100 index by using AI to select stocks based on positive sentiment from identified Nasdaq experts.

Strategic Approach: Combines machine learning with crowd-sourced wisdom, applying an Equal Risk Contribution (ERC) scheme for balanced stock weightings.

Performance Metrics:

- Total Return (Annualized): 17.36%

- Sharpe Ratio: 0.71

- Sortino Ratio: 1.00

- Winning Months: 59.49%

Top Holdings: Apple, Alphabet, Microsoft, Amazon.com Inc., PayPal Holdings

Minimum Investment: $500

Investor Suitability: Investors aiming to leverage crowd wisdom and AI for tech sector investments.

ALTIA-Investment Smart Portfolio

ALTIA-Investment focuses on large-cap equities in Europe and the US, using proprietary AI algorithms for intelligent quantitative management.

Key Areas of Capital Allocation: US and European large-cap equities.

Innovative Management Strategy: Utilizes advanced AI to adapt swiftly to market changes, with rigorous backtesting and proven real investment performance.

Performance Metrics: Designed for adaptability to market conditions and economic changes.

Minimum Investment: $500

Investor Suitability: Investors valuing technology-driven strategies with a scientific approach to asset management.

Why Invest in eToro’s AI Smart Portfolios?

- Diversification: Instantly diversify holdings across multiple assets and sectors.

- Advanced Technology: Leverage cutting-edge AI and machine learning for enhanced investment decisions.

- Accessibility: Low minimum investment requirements make these portfolios accessible to a wide range of investors.

- Performance: Historical performance data indicates strong returns, making these portfolios appealing for both new and experienced investors.

How to Get Started

- Sign Up: Create and verify your eToro account.

- Fund Your Account: Deposit funds using various available methods.

- Choose Your Portfolio: Select from the AI Revolution, GainersQtr, OutSmartNSDQ, or ALTIA-Investment portfolios.

- Monitor and Adjust: Use eToro’s tools to regularly check performance and adjust your strategy as needed.

Disclaimer: eToro is a multi-asset platform that offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more. Tax on profits may apply. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

eToro USA LLC does not offer CFDs and neither does it represent or assume any responsibility for the accuracy or completeness of the content of this publication, prepared by What is Bitcoin, as a partner, using information available and public and not specific to the eToro entity.

Company Overview

- Free Trial : Yes

- Features : eToro’s AI-Revolution and GainersQtr Smart Portfolios use AI to target tech-driven stocks and top-performing traders for smarter, diversified investing.

- Address : 24th Floor, One Canada Square, Canary Wharf, London, E14 5AB, United Kingdom

- Email : [email protected]

- Phone : +44 20 3868 7213

- Founded : 2007

- Company Website

Reviewed by 1 user

-

- by: Enda Cusack

- January 29, 2026 5:11 pm

eToro’s AI-managed portfolios provide a convenient way to gain diversified exposure with minimal effort, making them ideal for hands-off investors.

The automated strategy selection is a strong feature, though some users may prefer more customization or visibility into the underlying methodology.

Leave a Review