Seeking Alpha Review

Seeking Alpha is a leading financial research platform tailored to investors seeking high-quality stock analysis, data-driven ratings, and performance-focused tools. With a community of professional and retail analysts, institutional-grade quant systems, and proprietary stock screening capabilities, the platform caters to both self-directed investors and professionals.

Seeking Alpha offers three distinct services: Premium, Alpha Picks, and PRO.

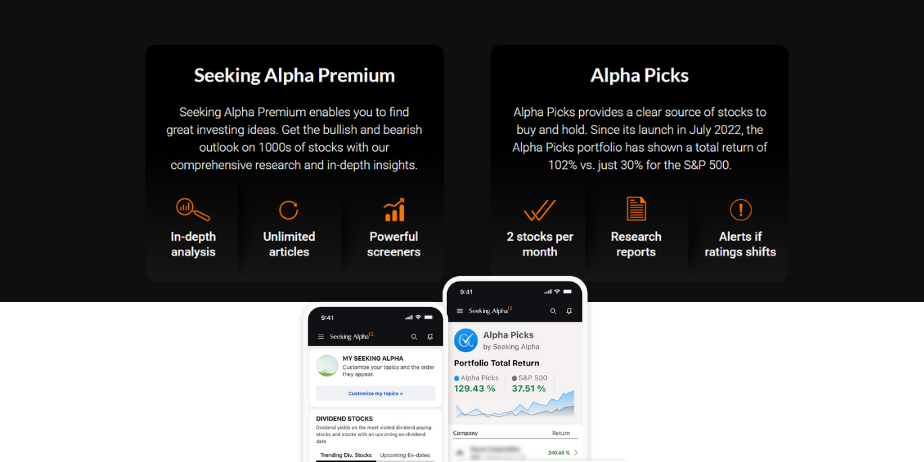

Seeking Alpha Premium

Investor Insights at Scale

Seeking Alpha Premium is built to equip individual investors with powerful, actionable insights. Subscribers gain full access to:

Quant Ratings

AI-powered stock ratings that have outperformed the S&P 500 by over 200 percent since inception. Ratings are derived from five critical metrics: Valuation, Growth, Profitability, Momentum, and EPS Revisions.

Unlimited Articles and Transcripts

Access exclusive research from analysts, earnings call transcripts, and curated investment ideas.

Factor Grades

Daily updated grading system across key financial pillars.

Advanced Screeners and Alerts

Filter stocks by dividend strength, earnings quality, or valuation, and receive alerts when ratings change.

Virtual Analyst Reports

Premium now includes AI-powered Virtual Analyst Reports, summarizing pros, cons, industry outlooks, and quant metrics in a single click. These reports are updated as new data becomes available, helping users make informed decisions faster.

Pricing

- Regular price: $299 per year

- Discounted offer: $269 per year for new subscribers

- 7-day free trial available

Alpha Picks

Market-Beating Stock Recommendations

Alpha Picks delivers two monthly ‘Strong Buy’ stock recommendations selected through Seeking Alpha’s rigorous quantitative analysis. The picks are tailored for long-term, buy-and-hold strategies with a focus on growth, value, and momentum.

Proven Outperformance

Since launch in July 2022, Alpha Picks has returned 280 percent compared to 83 percent for the S&P 500.

Transparent Methodology

Each selection is based on quant rankings, with sell alerts issued if a pick is downgraded or held for over 180 days.

Ongoing Support

Subscribers receive exclusive access to webinars, historical performance tracking, and portfolio updates.

Pricing

- Regular price: $499 per year

- Discounted offer: $449 per year for new members

Premium + Alpha Picks Bundle

Investors can access both platforms for a bundled price of $639 per year, saving $159 off the regular combined cost. This offer includes full Premium access and Alpha Picks subscriptions. It is designed for those seeking both deep research tools and curated stock ideas.

Seeking Alpha PRO

Institutional-Grade Research for Serious Investors

Seeking Alpha PRO is targeted at advanced investors, fund managers, and financial advisors looking for deeper insights and a disciplined strategy. Key features include:

Top Analyst Ideas

Track high-conviction buy calls from Seeking Alpha’s top 15 analysts.

PRO Quant Portfolio

A 30-stock model portfolio, rebalanced weekly, built using the Quant system. Since launch, it has consistently outpaced benchmarks.

Upgrades, Downgrades and Short Calls

Timely alerts on quant and analyst-driven rating changes and credible short ideas.

Unmatched Research Tools

Access over 1,300 under-the-radar stocks with professional-grade screeners and data visualization tools.

Pricing

- Introductory offer: $89 for the first month

- Annual subscription: $2,149 per year (discounted from $2,400)

Community and Contributor Network

Seeking Alpha sources investment ideas through a contributor model supported by a professional editorial team. Thousands of analysts and individual investors submit research, with many covering stocks overlooked by Wall Street. Contributors are paid based on engagement and can build a following while offering premium content through their own subscription services.

Seeking Alpha Performance Highlights

Quant ‘Strong Buy’ Stocks

201 percent total return vs. 62 percent for the S&P 500 (2009 to 2026)

Alpha Picks Portfolio

280 percent return since July 2022 vs. 83 percent for the S&P 500

PRO Quant Portfolio

Active performance tracking with weekly rebalancing and transparency into every move

User Feedback

Subscriber reviews consistently praise the platform’s utility and results:

“My Seeking Alpha subscription has been my best investment. After 90 days, I’m already making more from my trades than my day job.” – January 2025

“Terrific resource to help manage financial assets. The analysis is thorough and helps me align investments with my risk and return goals.” – March 2025

“I’ve tried other platforms, but Seeking Alpha works well even in uncertain markets.” – 2023 Alpha Picks Member

Seeking Alpha Discounts

Seeking Alpha Premium: Start for just $4.95 in your first month as a new subscriber, or save $30 on the annual plan and pay $269 instead of $299. Sign up

Alpha Picks Subscription: Get your first year for $449, a $50 discount from the regular price of $499. Sign up

Premium and Alpha Picks Bundle: Access both top-tier services for $639 for the first year, a $159 saving off the combined price of $798. Sign up

Seeking Alpha PRO: Ideal for serious investors, get your first month for $89, followed by a discounted annual rate of $2,149, saving $251 off the usual $2,400. Sign up

Company Overview

- Free Trial : Yes

- Features : Seeking Alpha offers stock ratings, analyst research, AI-powered reports, model portfolios, and advanced screening tools for informed investment decisions.

- Address : 52 Vanderbilt Ave, New York, NY 10017, United States

- Email : [email protected]

- Phone : 1‑347‑509‑6837

- Founded : 2005

- Company Website

Reviewed by 1 user

-

- by: Enda Cusack

- January 29, 2026 11:52 am

Clear, in-depth analysis and stock insights make Seeking Alpha a valuable research tool for any investor.

Customer support is prompt, professional, and solutions-focused.

Leave a Review