TuringTrader Review

TuringTrader Review: TuringTrader is a subscription-based platform that helps individuals manage their own investment portfolios using automated, rules-based strategies. It offers a range of professionally designed portfolios that are backed by data and thoroughly tested, with email alerts to guide rebalancing.

TuringTrader gives everyday investors access to tools and strategies typically used by professionals, without the high costs.

TuringTrader Features

Algorithmic Portfolios

TuringTrader’s portfolios span conservative, balanced, and aggressive investment goals. Each strategy is grounded in quantitative analysis and backtested to simulate real-world performance since 2007.

Tactical Asset Allocation

Rather than static buy-and-hold approaches, TuringTrader employs tactical allocation, adapting holdings based on market conditions using proprietary indicators like the Market Vane signal.

Rebalancing Alerts

Users receive email alerts for rebalancing on daily, weekly, or monthly schedules, depending on the selected strategy. Portfolios are updated outside market hours for easier execution.

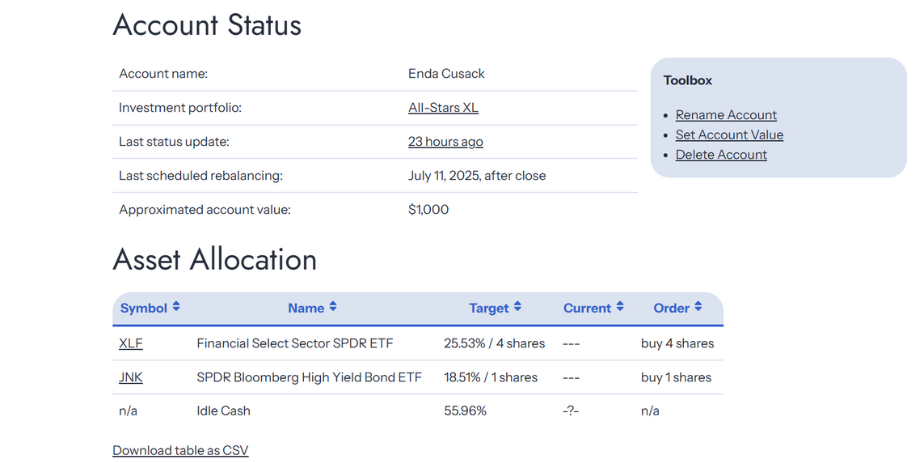

Customizable Dashboard

Investors manage their accounts via an intuitive dashboard with allocation tracking, performance metrics, and rebalancing tools.

Portfolio Wizard

To help investors find the most suitable strategies, TuringTrader includes a Portfolio Wizard that matches users with portfolios based on four key criteria: account size, investment horizon, risk tolerance, and tax status.

It uses Monte Carlo simulations to estimate downside risk and expected returns, making it easier to choose a portfolio aligned with personal goals.

Educational Resources

TuringTrader offers deep insight into portfolio mechanics, including performance metrics, drawdowns, and diversification strategies, supported by a detailed blog and research library.

TuringTrader Portfolio Options

TuringTrader offers over three dozen tactical portfolios grouped into three tiers:

Basic Portfolios (Free): Based on well-known published strategies from financial experts. Includes backtesting, charts, and key metrics.

Premium Portfolios: Proprietary strategies developed in-house. These expand upon foundational methods with advanced money management and tactical enhancements.

All-Stars Portfolios: Meta-portfolios that combine multiple Premium strategies for better diversification and lower volatility. Ideal for handling a wide variety of market conditions.

Notable Portfolio Examples

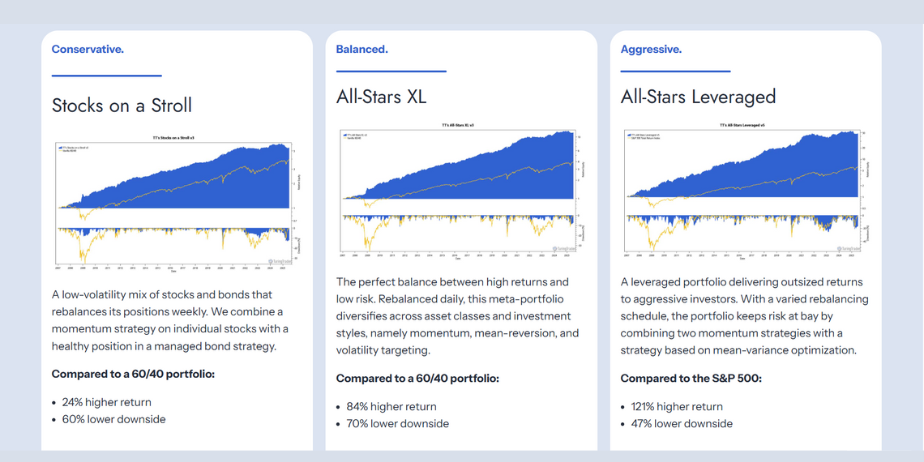

Stocks on a Stroll (Conservative)

A weekly rebalanced portfolio blending momentum-based stock selection with managed bond exposure. It targets long-term returns above a traditional 60/40 portfolio with less than half the drawdown.

All-Stars XL (Balanced)

A daily-rebalanced meta-portfolio combining six distinct strategies. It has delivered 84% higher returns and 70% lower downside risk compared to a standard 60/40 mix.

All-Stars Leveraged (Aggressive)

Designed for experienced investors, this portfolio applies moderate leverage and advanced diversification across equities, ETFs, and bonds, outperforming the S&P 500 by a wide margin with reduced volatility.

Performance

All strategies are rigorously backtested using TuringTrader’s open-source engine. Simulations include historical data, Monte Carlo scenarios, and key risk metrics such as drawdowns, Sharpe ratios, and Martin ratios.

The platform does not require trading account linking, and users retain full control over trade execution through their own brokerage accounts.

Pricing Plans

- Basic – Always free. Access to a selection of foundational portfolios.

- Premium – $41.50/month (annual billing). Includes proprietary and All-Stars portfolios, rebalance alerts, and performance tracking tools.

- Infinite – $66.50/month (annual billing). Adds account grouping, API access, and advanced automation capabilities.

A 14-day Premium trial is available for free with no credit card required. A $25 discount is available using the code ENDA25.

Ideal For

- Self-directed investors seeking to manage their portfolios more effectively.

- Individuals looking for cost-efficient alternatives to traditional financial advisors.

- Experienced investors interested in tactical, rules-based asset rotation and portfolio diversification.

$25 discount off TuringTrader with Referral Code "ENDA25"

Company Overview

- Free Trial : Yes

- Features : TuringTrader offers automated, backtested portfolios with rebalancing alerts, designed by experts to help individuals manage investments with confidence.

- Address : 721 4th Ave #353, Kirkland, WA 98033, USA

- Founded : 2018

- Company Website

Leave a Review