In an era when financial technology (fintech) is reshaping how consumers and institutions interact with their money, SoFi Technologies, Inc. (NASDAQ: SOFI) has emerged as a leading digital-first financial services provider. Founded at Stanford University in 2011, the company originally focused on offering more affordable student loans. Over time, it strategically expanded its business lines and, as of 2022, became a fully chartered U.S. bank. Today, SoFi’s portfolio spans a wide range of financial products, including lending, savings, investing, credit cards, insurance, and technology solutions for partners. This broad offering has positioned it as a “one-stop shop” for personal finance—a model it has continuously refined through advanced data analytics and, more recently, artificial intelligence (AI).

This review examines SoFi’s evolution from a niche loan provider to a comprehensive fintech platform, its latest financial results, the role of AI in its operational strategy, and how analysts currently view its stock. By exploring these dimensions, investors and customers alike can better understand SoFi’s current standing and potential in the ever-competitive fintech landscape.

SoFi Technologies History of Expansion

SoFi—short for Social Finance—began by connecting students and alumni through a lending model designed to offer more favorable loan terms than federal programs. This data-driven approach allowed the company to refine its underwriting practices, demonstrating early on that technology could improve both the borrower experience and investor returns. Over the next few years, SoFi steadily diversified, adding personal loans, mortgages, investment services, credit cards, and a growing lineup of deposit products.

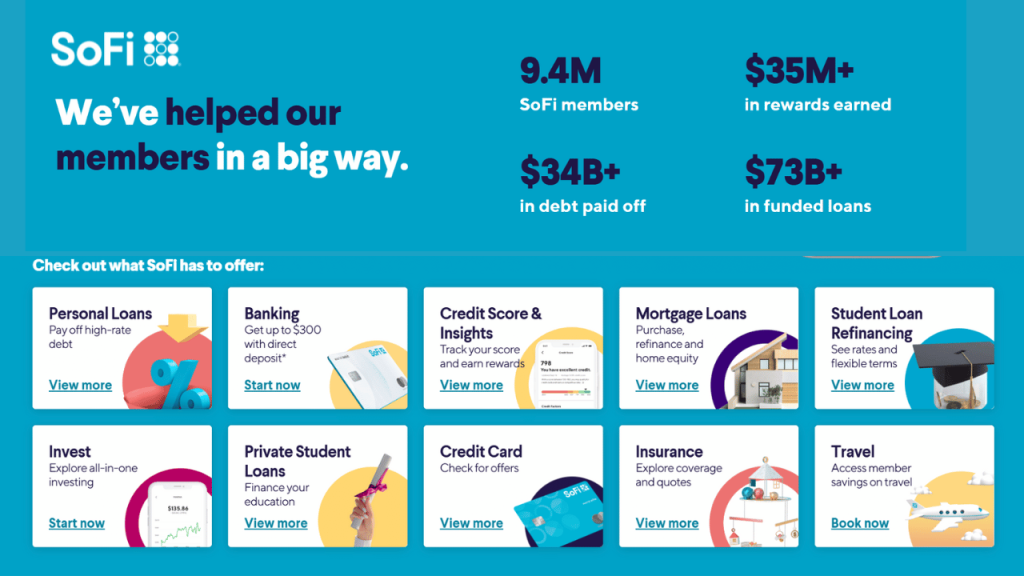

A pivotal moment arrived in 2022, when SoFi secured a U.S. bank charter through its acquisition of Golden Pacific Bancorp. With this charter in hand, SoFi gained greater control over its lending and deposit-taking activities, enabling it to operate with improved efficiency. By late 2024, the company served approximately 9.4 million customers and supported 160 million technology platform accounts, showing that it had firmly cemented itself as a top-tier digital financial institution.

Financial Performance and Valuation Metrics

SoFi’s revenue growth has been significant. From just under $1 billion in 2021, revenue surpassed $2 billion in 2023—an impressive feat illustrating growing brand recognition and product adoption. This period of rapid expansion has taken place amid efforts to bring the company closer to profitability. Historically, SoFi posted net losses as it invested in customer acquisition, platform enhancements, and compliance. However, the improved margins enabled by its bank charter have supported steady progress toward positive net income.

As of December 12, 2024, key metrics include:

- Stock Price: $15.94, near the higher end of its 52-week range ($6.01–$16.61).

- Market Capitalization: ~$16.59 billion, reflecting investor confidence in its long-term potential.

- Enterprise Value (EV): ~$20.67 billion, underscoring growth expectations.

- Valuation Ratios: With a P/E ratio of 135.4 and an EV/Revenue of 7.35, SoFi’s valuation remains elevated compared to traditional banks. A Price-to-Book (P/B) of 2.84 and Price-to-Sales (P/S) of 6.84 also suggest that investors are pricing in robust future earnings growth, aided in part by the company’s technological and AI-driven initiatives.

These multiples may appear high for a financial institution, but they reflect SoFi’s status as a growth-oriented fintech player. Investors are paying a premium for potential gains in efficiency, product cross-selling, and market share—all areas where AI integration could provide a competitive edge.

Earnings Trends and Analyst Perspectives

SoFi’s earnings trajectory has shown consistent year-over-year improvement. Early losses have gradually narrowed, driven by better underwriting models and cross-selling opportunities. In Q3 2024, SoFi outperformed analyst expectations, demonstrating resilience amid changing market conditions. Looking ahead to Q4 2024, consensus forecasts anticipate positive earnings per share (EPS) of $0.04, a sign that the company’s investments may be on the cusp of paying off.

Despite these positive developments, analyst sentiment is currently mixed. With 14 analysts covering the stock, the consensus rating is a “Hold.” While 5 maintain a “Buy” recommendation, 3 have issued “Sell” ratings, and 6 stand at “Hold.” The average 12-month price target of $11.46 suggests some near-term downside from current prices, reflecting concerns that the market may have priced in a good deal of SoFi’s expected growth too early. Rising interest rates, competition, and questions about sustaining rapid expansion weigh on these tempered outlooks.

On the other hand, bullish analysts see upside if SoFi continues to innovate and execute successfully. Price targets as high as $19.00 underscore the possibility that successful integration of AI and technology platforms could justify the premium valuation over time.

SoFi Technologies Acquisitions and Growth

SoFi’s journey includes strategic acquisitions that broadened its capabilities. Notably, the 2020 acquisition of Galileo, a payments and API platform, enabled SoFi to provide services to other fintechs. More recently, the 2023 purchase of Technisys, a cloud-based banking technology provider, further fortified its technology platform segment. These moves allow SoFi to integrate advanced analytics, AI-driven automation, and flexible APIs, facilitating a vibrant ecosystem where partners and customers can benefit from cutting-edge digital solutions.

Harnessing AI Across the Value Chain

While not a pure-play AI company, SoFi leverages machine learning and predictive analytics to enhance core aspects of its business. AI’s influence is evident in several areas:

- Credit Underwriting: By applying advanced models that go beyond traditional credit scores, SoFi refines its risk assessment. More accurate pricing of loans and better credit quality can reduce defaults and improve borrower satisfaction.

- Fraud Detection and Security: As transaction volumes grow, AI-driven safeguards help detect suspicious activity earlier. This capability is increasingly vital as SoFi works to strengthen its security measures, following regulatory scrutiny in 2024 related to fraud prevention lapses.

- Personalized User Experiences: With a large and diverse customer base, AI helps tailor product recommendations, whether for new credit lines, investment options, or insurance solutions. Chatbots and virtual assistants powered by AI can also streamline customer service, creating a more intuitive user experience.

- Platform Solutions for Partners: Through Galileo and Technisys, SoFi’s white-label technologies are available to other financial institutions. AI integration here can expedite product launches and improve partner platforms, contributing to the broader fintech ecosystem.

Challenges and Risk Considerations

No growth story comes without hurdles. As SoFi expands, it must continuously manage regulatory requirements and uphold best-in-class security to maintain customer trust and meet compliance standards. Economic uncertainty and interest rate fluctuations can also affect lending margins and default rates, even when sophisticated AI models are in place. Competition remains fierce, with both legacy banks and new fintech entrants vying for digital-savvy customers.

Looking Ahead: AI as a Catalyst for Sustainable Growth

The financial services sector is poised for an AI-driven transformation that will likely deepen over the coming years. SoFi’s trajectory, supported by technology-forward acquisitions and strategic platform enhancements, positions it favorably to capitalize on these trends. By further integrating AI for underwriting, fraud prevention, personalization, and partner-facing solutions, SoFi can continue to differentiate itself in a crowded market.

The company’s progress toward profitability, coupled with steadily improving customer retention and cross-selling metrics, suggests that its long-term vision has traction. While current valuations and analyst targets indicate some caution, the combination of fintech expertise, bank charter stability, and technology innovation provides a solid foundation for sustainable growth.

Conclusion

SoFi Technologies, Inc. stands out as a fintech leader that has successfully broadened its scope from student loan refinancing to a full-service banking platform. Investors assessing the company’s stock must weigh its considerable growth potential and ongoing AI-driven innovations against its premium valuation and short-term analyst skepticism. The evolving landscape of AI in finance presents both an opportunity and a challenge, and SoFi’s response—strategic acquisitions, platform expansion, and continuous refinement of AI capabilities—positions it to be a key participant in finance’s next chapter.

For those watching the intersection of technological advancement and financial services, SoFi’s journey offers a case study in how integrated, AI-enabled platforms can shape the future of banking, lending, and personal finance. As the company solidifies its operations and strategically harnesses AI, its role as a premier digital financial partner may become even more pronounced.