In the rapidly evolving financial landscape, eToro emerges as a beacon for smart investors seeking innovative and diversified investment solutions. The eToro AI Smart Portfolio represents a significant leap forward, marrying traditional investment strategies with the cutting-edge capabilities of artificial intelligence (AI). This unique blend offers a promising avenue for investors looking to navigate the complexities of today’s markets. But is it the right choice for you?

Understanding Smart Portfolios

At its core, a Smart Portfolio is a curated collection of investments, meticulously designed and managed by eToro’s seasoned analysts. These portfolios are not just a random assembly of stocks or assets; they are a strategic alignment of investments, each serving a specific purpose and following a unique investment strategy. With over 65 Smart Portfolios available, eToro provides a broad spectrum of themes, trends, and industries, each aiming for optimal long-term performance without the burden of portfolio management fees.

Enda CusackeToro AI Smart Portfolios: A Comprehensive Guide

eToro offers several AI-driven Smart Portfolios designed to leverage advanced technologies and expert strategies. These portfolios are designed either to invest in AI-related stocks or use AI to manage the investment process. Here are the four prominent AI Smart Portfolios available on eToro:

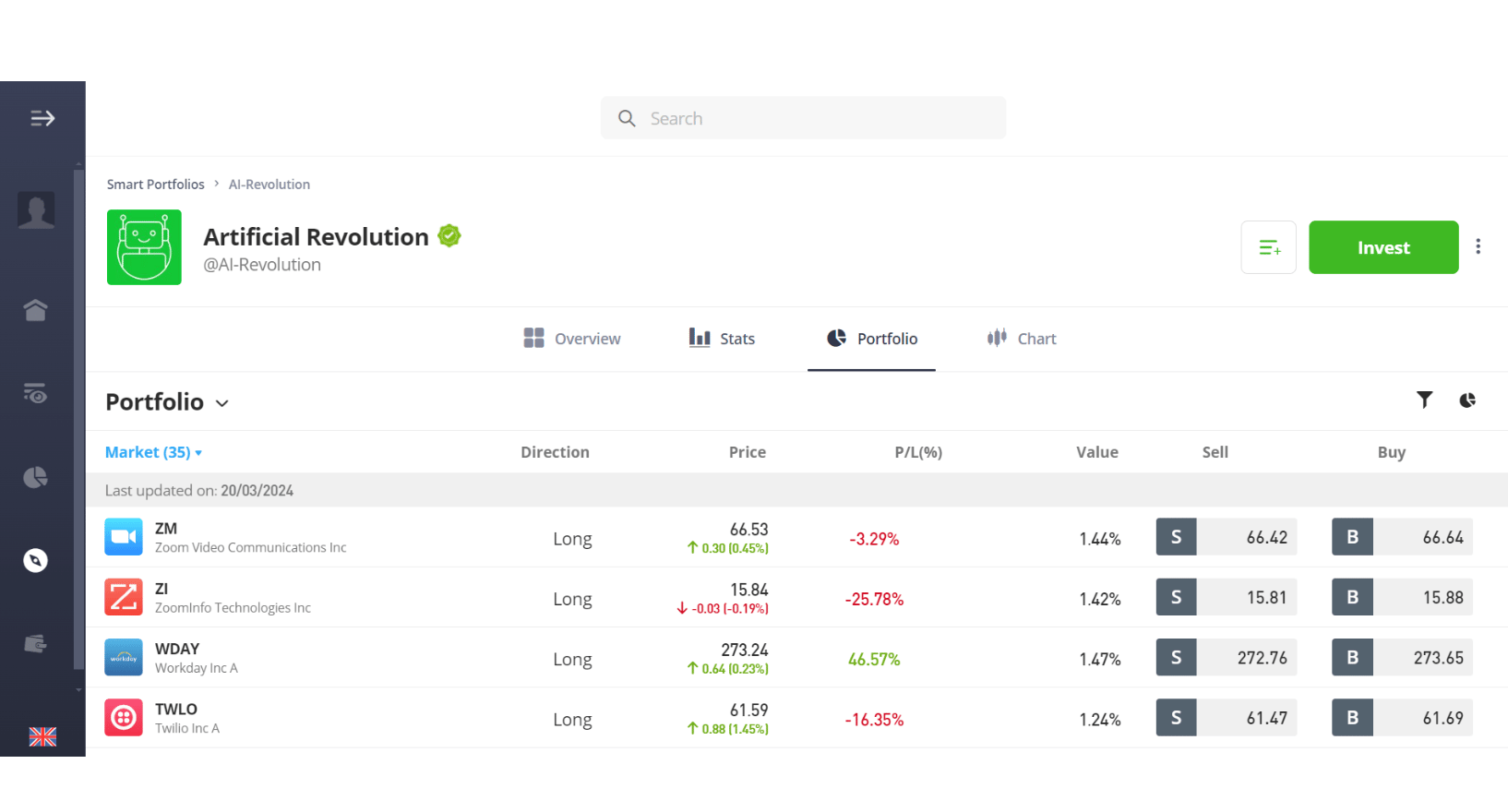

1. AI Revolution SmartPortfolio

Description: The AI Revolution SmartPortfolio focuses on investing in companies that are at the forefront of artificial intelligence development. This portfolio allocates capital to firms developing cutting-edge AI technologies and those integrating AI into their business models.

Key Features:

- Composition: 75% allocated to companies providing AI infrastructure (software, cloud, semiconductors, etc.) and 25% to companies utilizing AI in their operations.

- Notable Holdings: NVIDIA Corporation, Taiwan Semiconductor Manufacturing Co Ltd, Micron Technology, Palantir Technologies, Broadcom Inc.

- Performance: Offers a substantial return with an annualized total return of 30.17%.

- Geographic Exposure: Predominantly U.S.-based with additional exposure to China, Taiwan, Israel, and Australia.

- Minimum Investment: $500.

2. GainersQtr SmartPortfolio

Description: The GainersQtr SmartPortfolio leverages machine learning to select top-performing traders on the eToro platform. It aims to copy the trades of these selected users, providing a diversified, low-risk investment strategy.

Key Features:

- Composition: Includes stocks, forex, indices, commodities, and cryptocurrencies, focusing on diversified and uncorrelated instruments.

- Notable Holdings: Invesco QQQ, Alphabet, Apple, SPDR S&P 500 ETF, Amazon.com Inc.

- Performance: Annualized total return of 11.32% with a focus on stability and consistent performance.

- Geographic Exposure: Diverse, with significant investments in the United States, Britain, and global markets.

- Minimum Investment: $5,000.

3. OutSmartNSDQ SmartPortfolio

Description: The OutSmartNSDQ SmartPortfolio aims to outperform the Nasdaq 100 index by combining machine learning with crowd wisdom. It identifies stocks with the most positive sentiment among Nasdaq experts.

Key Features:

- Composition: Focuses on 15 Nasdaq-listed stocks selected based on positive sentiment from identified experts.

- Notable Holdings: Apple, Alphabet, Microsoft, Amazon.com Inc, PayPal Holdings.

- Performance: Seeks to outperform the Nasdaq 100 index with an annualized total return of 17.36%.

- Geographic Exposure: Primarily U.S.-based.

- Minimum Investment: $500.

4. ALTIA-Investment Smart Equity Portfolio

Description: Developed by ALTIA Investment, this portfolio uses AI-driven quantitative management models to invest in large-cap European and U.S. equities. It focuses on a balanced equity strategy, aiming for growth through intelligent model-driven decisions.

Key Features:

- Composition: Long-only equity mutual fund investing in large-cap stocks in Europe and the U.S.

- Technology: Utilizes advanced AI algorithms for investment decisions, focusing on adaptability and optimization.

- Performance: Designed to balance concentration, diversification, and liquidity to manage market risks effectively.

- Minimum Investment: Specific details not provided, but the approach aligns with professional asset management practices.

eToro’s AI Smart Portfolios provide diverse investment options, whether you’re looking to capitalize on the growth of AI technologies or benefit from AI-driven portfolio management. Each portfolio is tailored to different investment strategies and risk appetites, offering exposure to some of the most innovative and dynamic sectors in the market today.

The Core of Your Investment Strategy

Choosing to invest in an eToro Smart Portfolio means aligning with a long-term financial goal, guided by the expert asset allocation advice of companies such as eToro and BlackRock. This approach ensures that investors are not just throwing money into the latest trend but are making considered decisions that align with their financial objectives.

Diversification and Long-term Growth

The hallmark of a wise investment strategy is diversification, and the eToro AI Smart Portfolio excels in this area. By spreading investments across various sectors, regions, and asset classes, these portfolios mitigate risk while capturing the potential for growth in a dynamic market environment. The focus on long-term, research-backed selections of companies and assets from around the globe reinforces the commitment to sustained growth.

Accessibility and Innovation

One of the most appealing aspects of the eToro AI Smart Portfolio is its low barrier to entry, with initial investments starting at just $500. This democratization of investing allows individuals at any level to participate in the financial markets in a meaningful way. Moreover, the portfolios are built using the latest technology and data, ensuring they remain relevant and adaptable to market changes.

Dividend Reinvestment and Active Management

An added benefit of investing in a Smart Portfolio is the dividend reinvestment feature. Dividends are automatically added to the portfolio’s cash balance and reinvested, compounding the growth potential. Despite leaning towards a passive investment strategy, eToro’s portfolios are anything but static. Regular rebalancing and fine-tuning by the investment team ensure alignment with the original strategy and optimization for performance.

The AI Edge

The AI Revolution Smart Portfolio, in particular, is a testament to eToro’s commitment to leveraging technology for investment success. By focusing on companies at the forefront of AI technology and applications, this portfolio is positioned to capitalize on the transformative potential of AI across industries. With AI’s role in enhancing efficiency and driving innovation, investors have a unique opportunity to be part of the next wave of technological advancement.

A Partnership for the Future

eToro’s collaboration with InvestorAi and STRATxAI further underscores the platform’s innovative edge. These partnerships bring sophisticated AI-driven analysis and insights, previously the domain of institutional investors, to the individual investor. The result is a portfolio strategy that is not only grounded in comprehensive data and advanced analytics but also accessible to a wider audience.

Making the Decision

Investing in the eToro AI Smart Portfolio offers a blend of innovation, diversification, and accessibility, backed by the expertise of eToro’s investment team and the power of AI. For those looking to invest in a future shaped by technological advancement, while adhering to sound investment principles, the eToro AI Smart Portfolio presents a compelling option.

However, as with any investment, it’s important to consider your financial goals, risk tolerance, and investment horizon. The eToro AI Smart Portfolio, with its focus on long-term growth and technology-driven strategies, may not be suitable for everyone. Investors should conduct their due diligence and possibly consult with a financial advisor to ensure that this investment aligns with their overall financial plan.

In conclusion, for those intrigued by the intersection of technology and finance, and who are seeking a diversified, long-term investment solution, the eToro AI Smart Portfolio is certainly worth considering. Its unique approach to investing, leveraging the capabilities of AI and the expertise of eToro’s analysts, offers a smart pathway to potentially achieve your financial objectives.

Disclaimer: eToro is a multi-asset platform that offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more. Tax on profits may apply. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

eToro USA LLC does not offer CFDs and neither does it represent or assume any responsibility for the accuracy or completeness of the content of this publication, prepared by What is Bitcoin, as a partner, using information available and public and not specific to the eToro entity.