Palantir Technologies Inc. (NYSE: PLTR) has emerged as a major player in the field of artificial intelligence (AI) and big data analytics, drawing considerable attention from investors and analysts alike. In this comprehensive review, we delve into the factors influencing Palantir’s stock performance, the company’s financial metrics, its AI-driven innovations, and its strategic positioning within both government and commercial markets.

Palantir Technologies Stock Performance

Palantir’s stock experienced a meteoric rise in 2024, advancing 344%, with much of the gain attributed to factors such as Donald Trump’s re-election and a strong third-quarter earnings report. The inclusion of Palantir in the S&P 500 index on September 23, 2024, further boosted its appeal among institutional investors. However, the stock’s current price of $70.89, as of December 11, 2024, reflects a high valuation that has sparked debates among analysts.

Technical Analysis

- Relative Strength Rating: 99 (out of a possible 99), indicating strong performance relative to peers.

- Composite Rating: 99, which combines various proprietary metrics to assess growth potential.

- Accumulation/Distribution Rating: A, signaling significant institutional buying over the past 13 weeks.

- Entry Point: PLTR is currently well above its 5% buy zone, trading at a premium.

Valuation Metrics

Palantir’s valuation is a point of contention, with a Price-to-Earnings (P/E) ratio of 386.5 and a Price-to-Sales (P/S) ratio of 61.84. While these metrics are high, Palantir’s strong growth narrative and potential in AI-driven markets keep investors intrigued.

Key Developments in 2024

Government Contracts and Defense Partnerships

-

Expansion with U.S. Special Operations Command (USSOCOM): Palantir secured a $36.8 million contract extension, becoming the lead software integrator for the Mission Command System. This highlights Palantir’s critical role in military operations.

-

Project Maven: The U.S. Army extended Palantir’s Maven Smart System (MSS) contract for five years, with an estimated annual revenue of $90 million.

-

TITAN Contract: A new $178 million U.S. Army contract for the Tactical Intelligence Targeting Access Node underscores Palantir’s expertise in battlefield AI systems.

Commercial Market Expansion

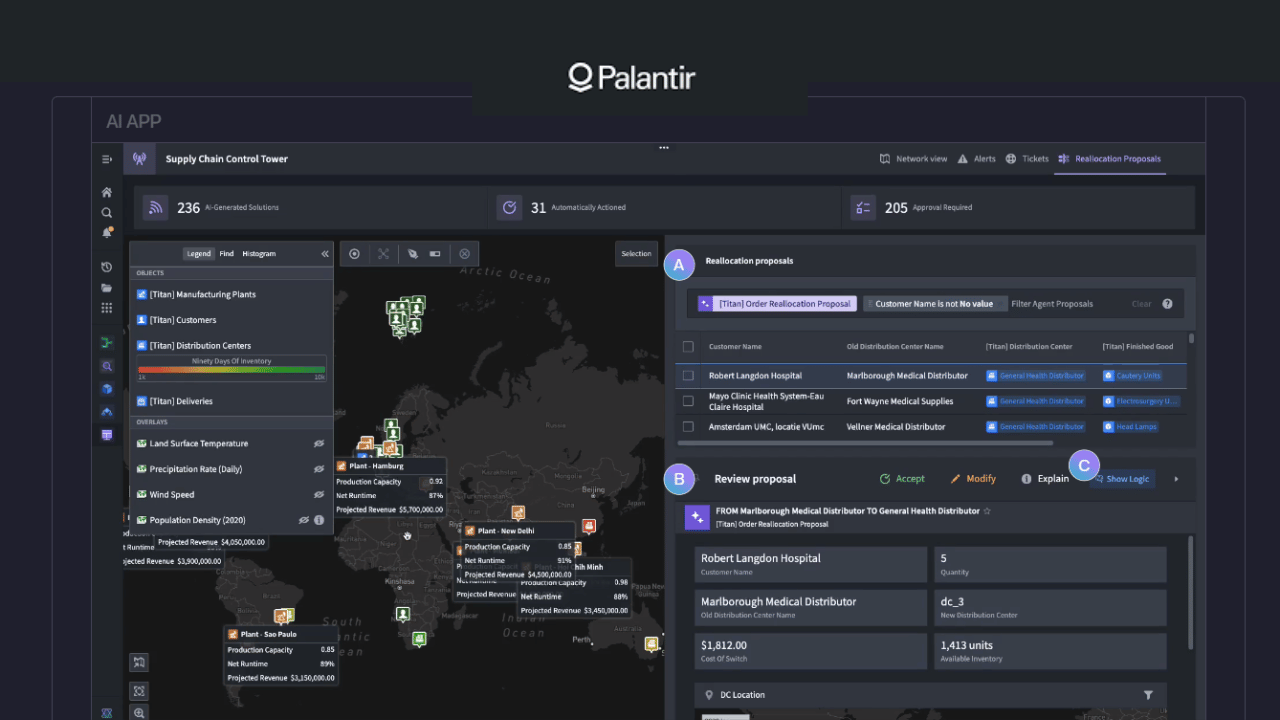

Palantir’s Artificial Intelligence Platform (AIP), launched in early 2023, continues to gain traction in the commercial sector. Notable applications include:

- Supply Chain Management: Demonstrated at AIPCon 5, companies like Aramark showcased Palantir’s AI capabilities in optimizing logistics.

- Healthcare: Mount Sinai utilized Palantir’s tools for improving patient care.

- Generative AI Integration: Partnerships with Amazon Web Services and Anthropic aim to expand Palantir’s generative AI offerings.

Palantir Technologies Financial Performance

Revenue Growth Trends

Palantir’s revenue growth has decelerated in recent years, raising concerns among some investors:

- 2020: 47%

- 2021: 40%

- 2022: 24%

- 2023: 17%, totaling $2.23 billion.

Despite this slowdown, the company’s profitability has improved, with analysts projecting stronger revenue contributions from its generative AI initiatives by 2025.

Profitability Metrics

- Net Income Margin: Improved, supported by higher-margin government contracts.

- Cash Reserves: $4.56 billion as of the latest filings, providing a solid buffer for future investments.

AI Innovations and Market Leadership

Palantir is leveraging its technological edge to dominate the AI landscape, particularly in high-stakes applications like defense, intelligence, and healthcare. The company’s AIP integrates seamlessly with its other platforms—Gotham, Foundry, and Apollo—to create a cohesive ecosystem.

- AIP Features: Real-time AI-driven decision-making, extensive ontology-based data integration, and robust security.

- MetaConstellation: A satellite-based AI network for real-time geospatial analysis.

- Skykit: A portable AI toolbox designed for frontline intelligence operations.

These innovations position Palantir as a critical enabler of AI applications in both public and private sectors.

Bull vs. Bear Case

Bull Case

- Market Leadership: Palantir’s dominance in AI-driven government applications provides a stable revenue base.

- Expanding Commercial Presence: Success in the healthcare and supply chain sectors highlights the scalability of its AI solutions.

- Strong Institutional Support: Inclusion in the S&P 500 index attracts long-term investors.

Bear Case

- High Valuation: Elevated P/E and P/S ratios may deter value-oriented investors.

- Revenue Growth Concerns: Slower growth in recent years raises questions about sustained scalability.

- Dependence on Government Contracts: Nearly 60% of revenue comes from government clients, exposing the company to geopolitical risks.

Conclusion: Buy or Sell?

Palantir Technologies Inc. is a polarizing stock, with its high valuation balanced by its leadership in AI and robust government partnerships. While the commercial sector offers promising growth avenues, the company’s financial metrics suggest caution for investors focused on near-term profitability.

For risk-tolerant investors seeking exposure to cutting-edge AI technologies, Palantir remains an intriguing option. However, those wary of high valuations and decelerating revenue growth may prefer to wait for a more attractive entry point.

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial or investment advice.